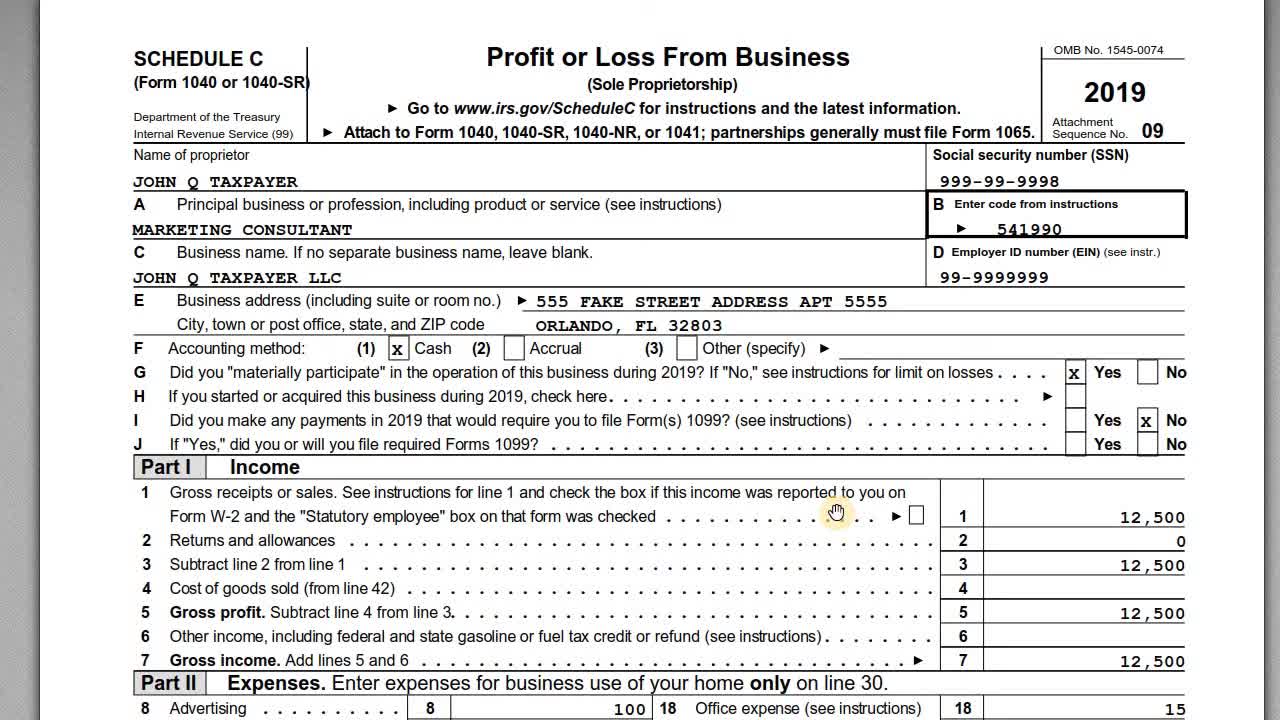

Irs Self Employment Tax Form 2024. A description of the business units can be found at: Mark when tax returns are due.

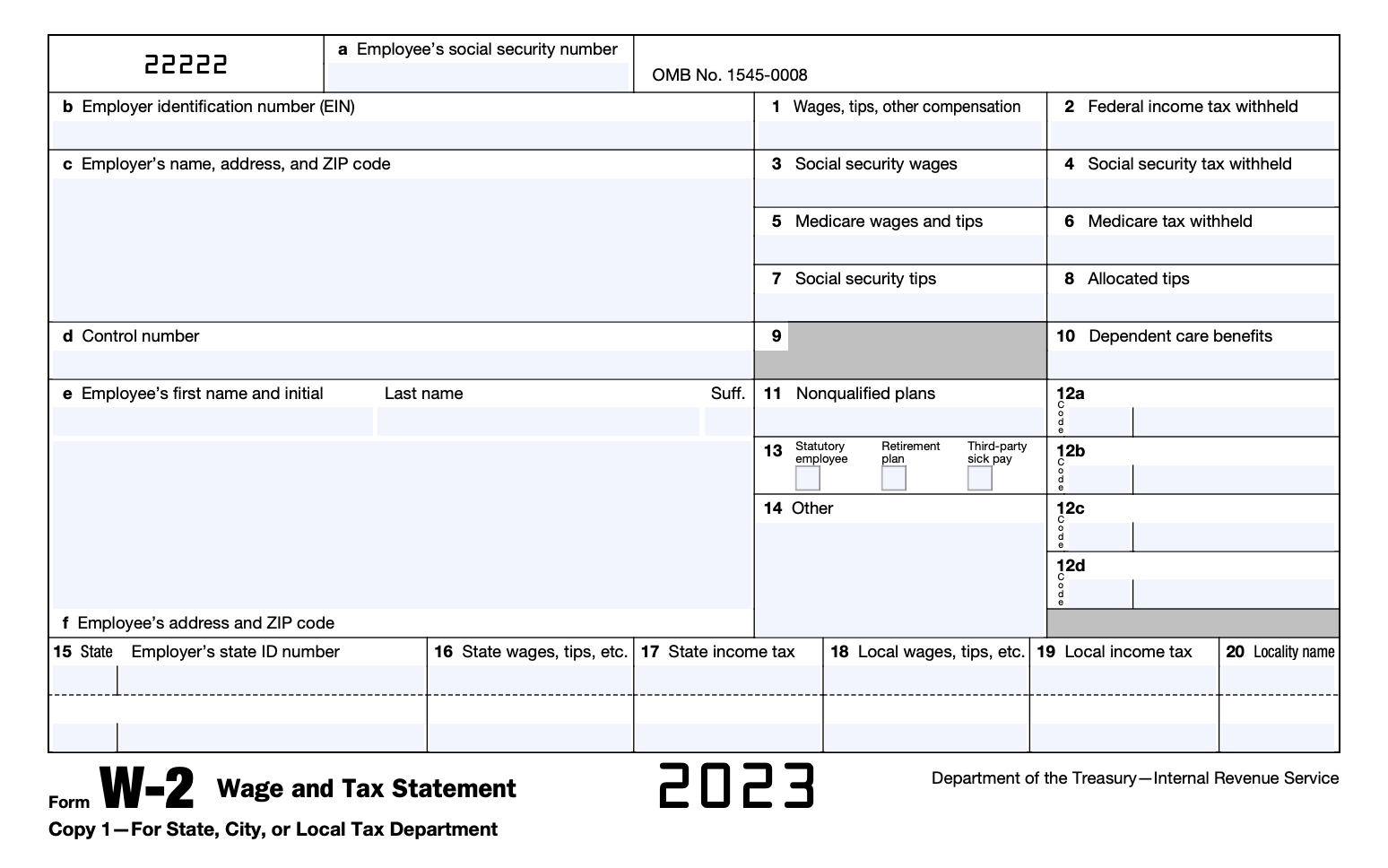

Fica contributions are shared between the employee and the employer. Key areas for deductions include home office.

Irs Self Employment Tax Form 2024 Images References :

Source: nadyaqmyriam.pages.dev

Source: nadyaqmyriam.pages.dev

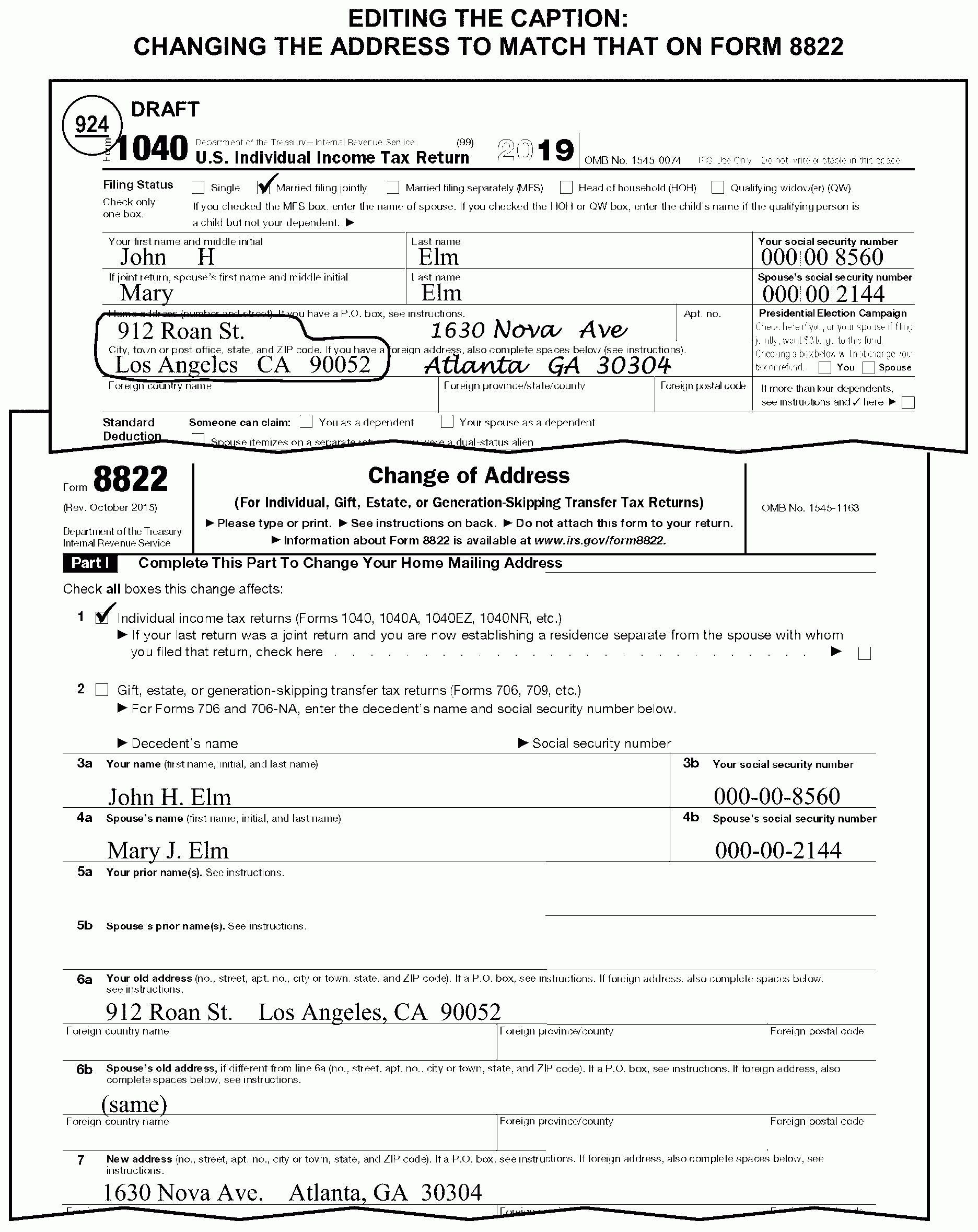

2024 Form 1040 Schedule 2 Instructions Are aurie shaylyn, Learn more about this agency.

Source: melloneywnanni.pages.dev

Source: melloneywnanni.pages.dev

2024 Irs Tax Forms Printable W4 June Sallee, The social security administration (ssa) uses the information from schedule se to figure your benefits under the social security program.

Source: www.employementform.com

Source: www.employementform.com

How To Fill Out Selfemployment Tax Form Employment Form, — there is no specific minimum income requirement for contributing to a roth ira, but you must have earned income to make contributions.

Source: lorenawkacey.pages.dev

Source: lorenawkacey.pages.dev

Irs Form W4 2024 Printable Free Cordi Paulita, Learn more about this agency.

Source: cecilbmodestine.pages.dev

Source: cecilbmodestine.pages.dev

2024 2024 Tax Form Pdf Rea Kiersten, File if church employee income is $108.28 or more.

Source: www.employementform.com

Source: www.employementform.com

Self Employment Estimated Tax Form Employment Form, — how to claim the credit.

Source: adibnikolia.pages.dev

Source: adibnikolia.pages.dev

Estimated Tax Payments 2024 Self Employed Nert Sibylle, Where can i find out more about other irs careers?

Source: etheldawdyna.pages.dev

Source: etheldawdyna.pages.dev

2024 Self Employment Tax Form Brita Fenelia, To claim a general business credit, you will first have to get the forms you need to claim your current year business credits.

Source: bernettewjanet.pages.dev

Source: bernettewjanet.pages.dev

Irs Tax Forms 2024 Printable Free Pdf File Gabbey Emmalee, Irs employees must complete the.

Source: liamelisse.pages.dev

Source: liamelisse.pages.dev

Irs W2 Form 2024 Karia Marleah, Get instructions on how to file schedule se tax.